Annual Retirement Savings & Tax Guide: The 'Cheat Sheet' 2025

by Jesse Fulton - Monday, 20 January, 2025

Each year, the College for Financial Planning compiles a comprehensive list of contribution limits to everything from 401(k) plans and Individual Retirement Accounts to Medicare as well as health savings accounts.

As we did last year, IFA has worked with the college to turn such tables for 2025 contribution limits into a series of graphics.

Below is a breakdown with some key contribution limits in 2025. It's designed to act as a sort of 'cheat sheet' for you to discuss different financial and investment-related matters with IFA's team of wealth advisors and tax planners.

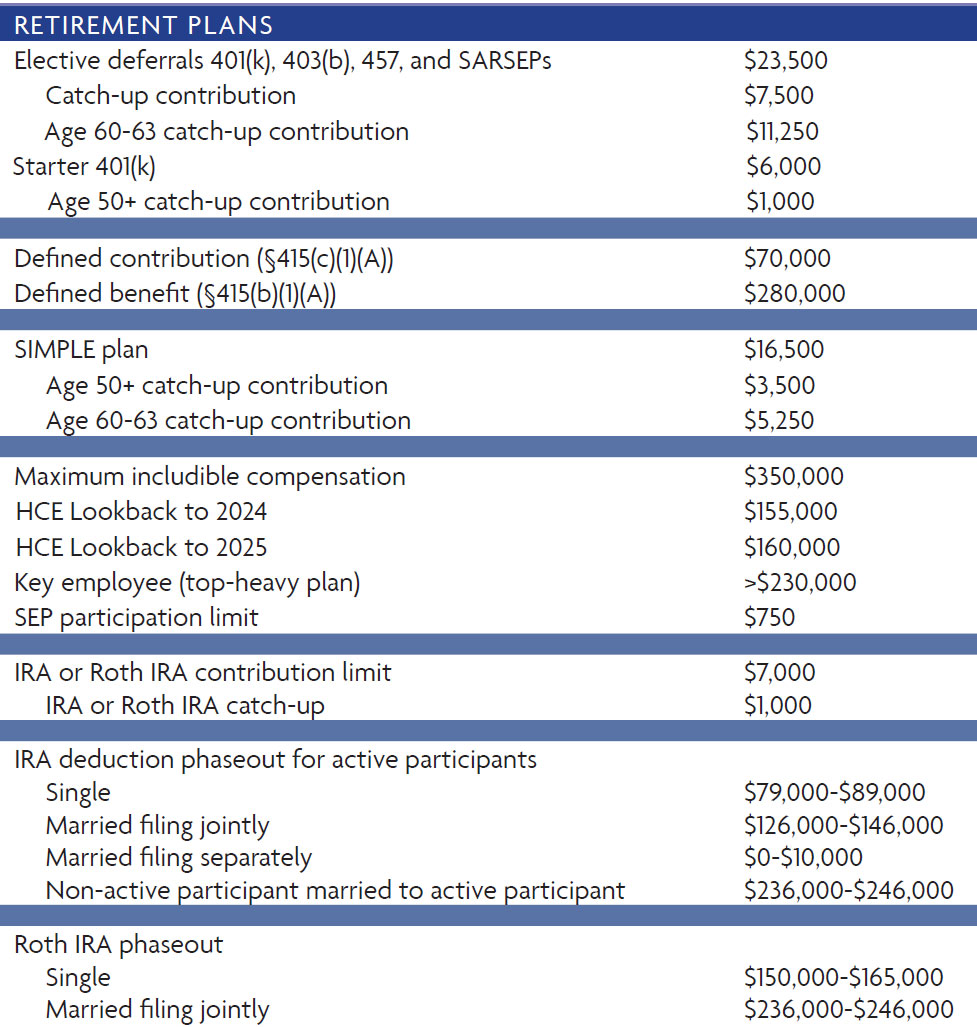

Retirement Plans

In 2025, elective deferrals to workplace retirement savings programs such as 401(k) and 403(b) plans are going up by $500 to $23,500 a person for those under the age of 50. For those aged 50 and up, a worker can still contribute an additional $7,500, which is the same as in the previous year. That means total contributions for those aged 50 and older rise to $31,000 in 2025.

Also of note: IRA and Roth IRA contribution limits stay the same for 2025 at $7,000 per person. For those age 50 and older, the catch-up contribution holds steady at $1,000. Meanwhile, SIMPLE plan contributions rose by $500 per person in 2025 to $16,500 with the catch-up (50 or older) remaining at $3,500 per person.

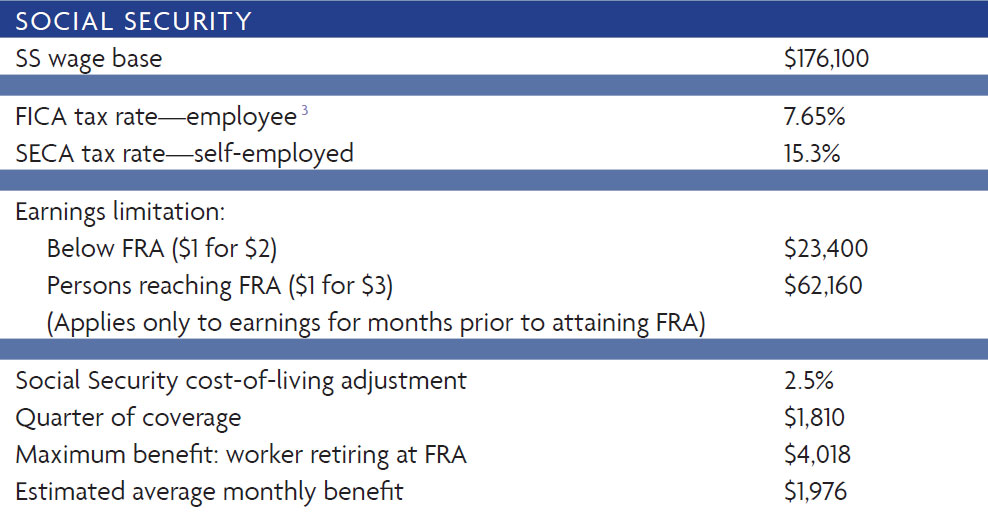

Social Security

In 2025, the taxable wage base went up by $7,500 to $176,100 a person. Another notable change was an increase of $196 a person to $4,018 in the maximum monthly benefit for a worker retiring at full retirement age. Meanwhile, Social Security's annual cost-of-living adjustment decreased in 2025 to 2.5%, down from the previous year's 3.2% adjustment. (Note: FICA refers to the Federal Insurance Contributions Act and SECA is the Self Employed Contributions Act. Also, FRA stands for "Full Retirement Age.")

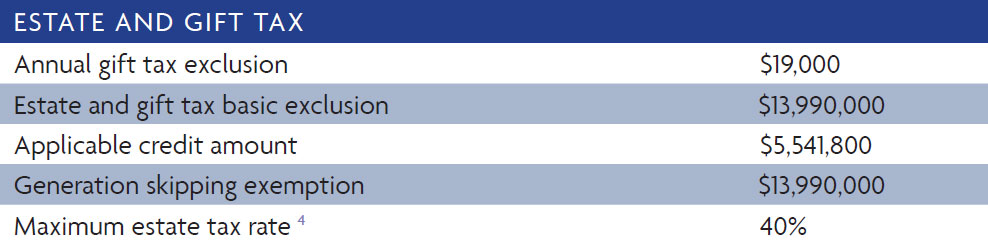

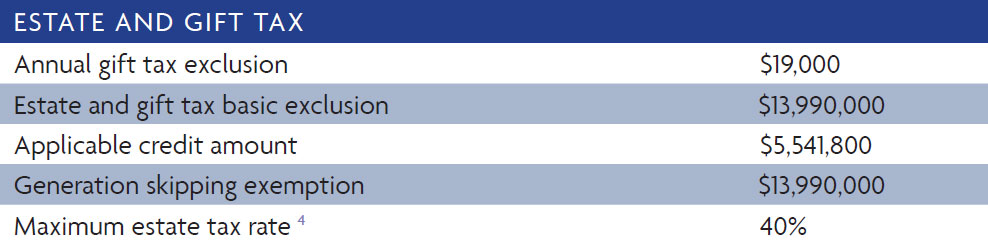

Estate & Gift Tax

The annual gift tax exclusion went up $1,000 per person to $19,000 and the maximum estate tax rate stayed at 40% in 2025. But the estate and gift tax exclusion rose to $13.99 million from the previous year's $13.61 million.

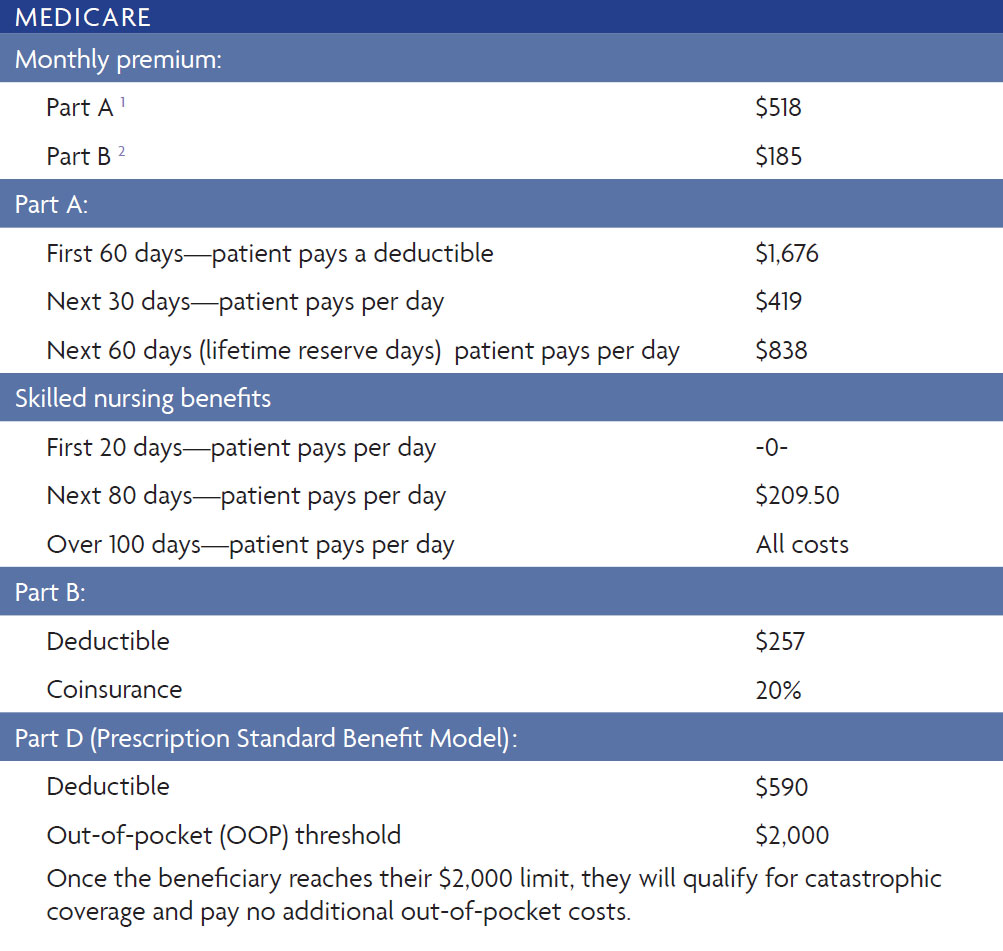

Medicare

The Part A standard monthly premium in 2025 increased slightly to a maximum of $518 (from $505 in 2024). At the same time, the base Part B monthly premium rose to $185 (from $174.70). (See footnotes below.) Skilled nursing care costs went up by $5.50 per day and the Part B deductible increased $17 to $257 in 2025. In terms of Part D, the deductible is $46.50 a month or $558 a person per year. Also, the out-of-pocket threshold for Part D is capped at $2,000 in 2025.

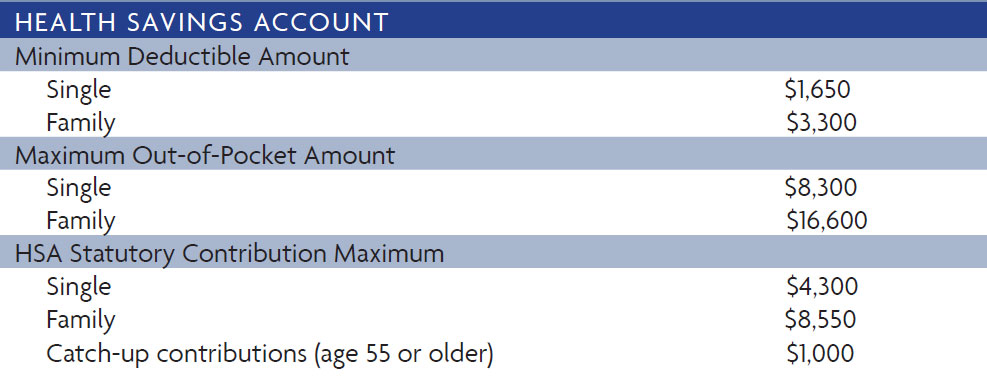

Health Savings Account

The minimum deductible amount for a single saver went up by $50 to $1,650 a person. For a family, it rose by $300 to $3,300. The maximum out-of-pocket amount has gone up — $250 more this year to $8,300 for a single person and $500 more to $16,600 for a family. The HSA statutory contribution maximum is also higher for a single saver ($4,300 vs. $4,150 in the previous year) and a family ($8,550 vs. $8,300). The catch-up contribution, however, for those age 55 or older stays at $1,000 in 2024.

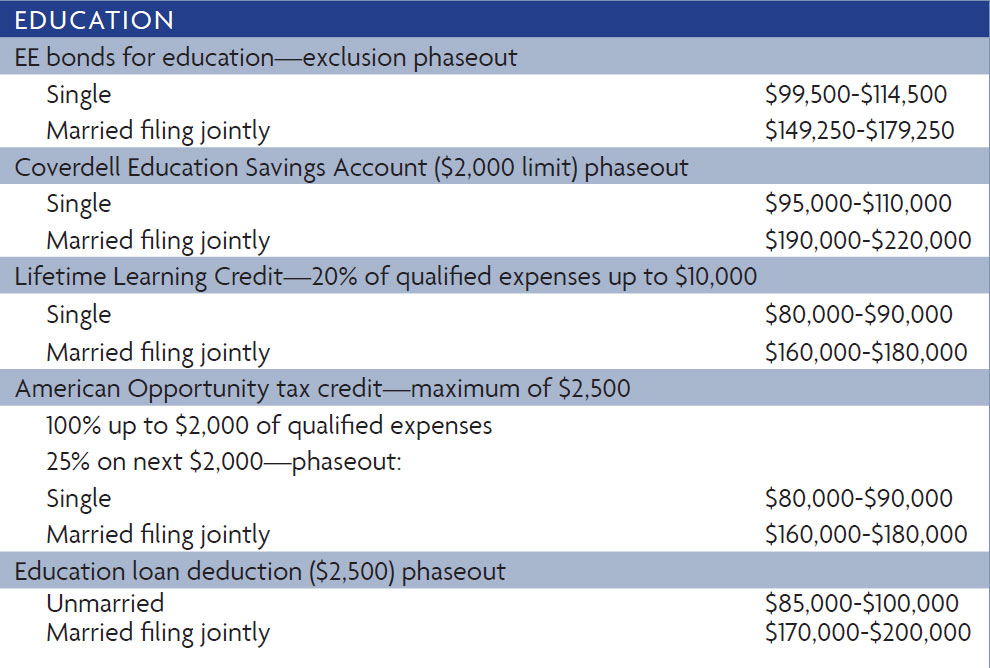

Education

The exclusion phaseout for EE bonds used for education by single tax filers increased to $99,500-$114,500 in 2025. In the previous year, the range was $96,800-$111,800. For those married filing jointly, the exclusion phaseout for EE bonds rose to $149,250-$179,250 (from $145,200-$175,200 in 2024). The phaseout levels for tax savings on a Coverdell Education Savings Account, both for single taxpayers as well as those who are married and filing jointly, stayed the same in 2025. Those are: $95,000-$110,000 for single and $190,000-$220,000 for people who are married and filing jointly. As shown in the table below, the phaseout ranges for the Lifetime Learning Credit also stayed the same in 2025 at $80,000-$90,000 for individuals and $160,000-180,000 for those married and filing jointly.

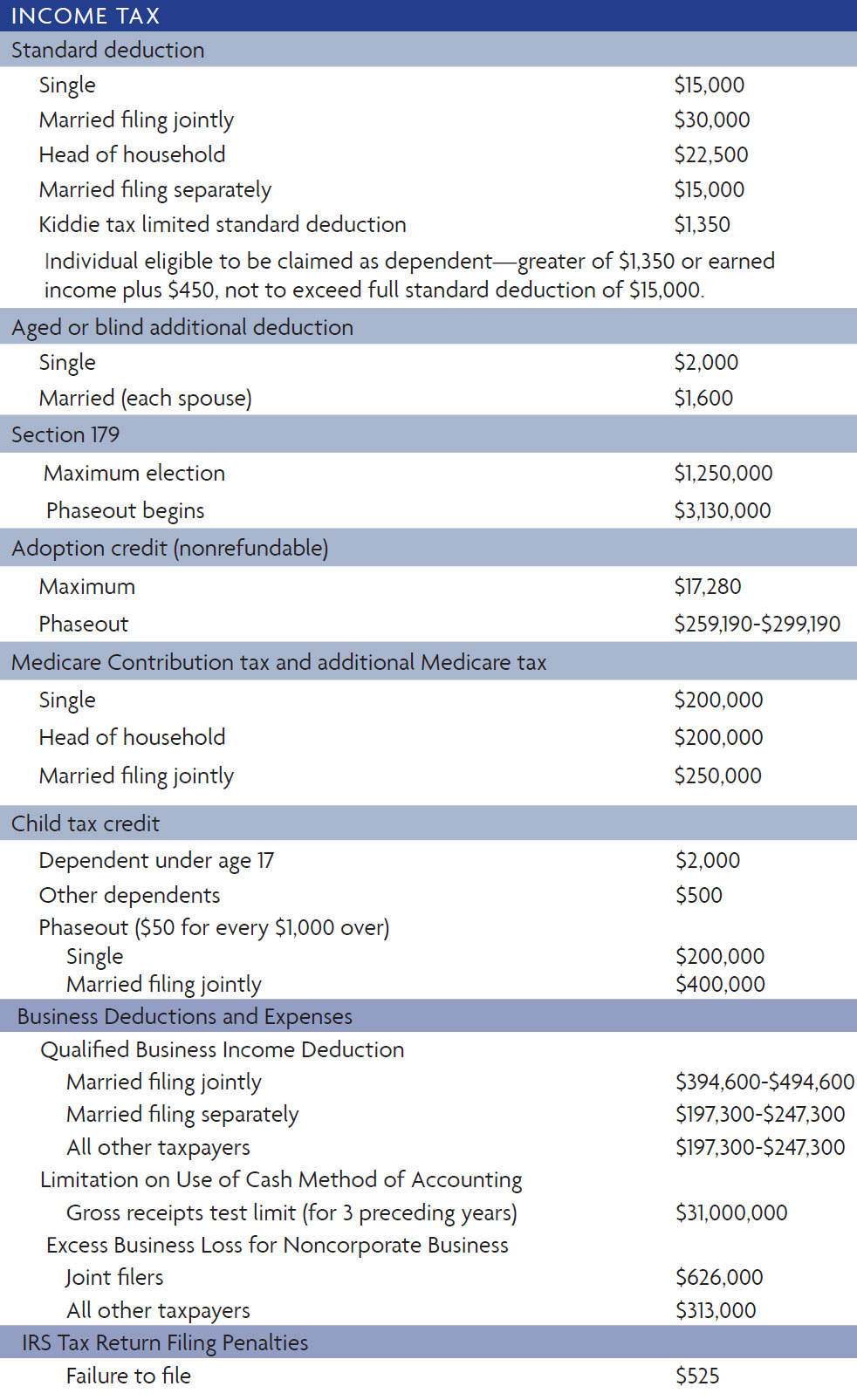

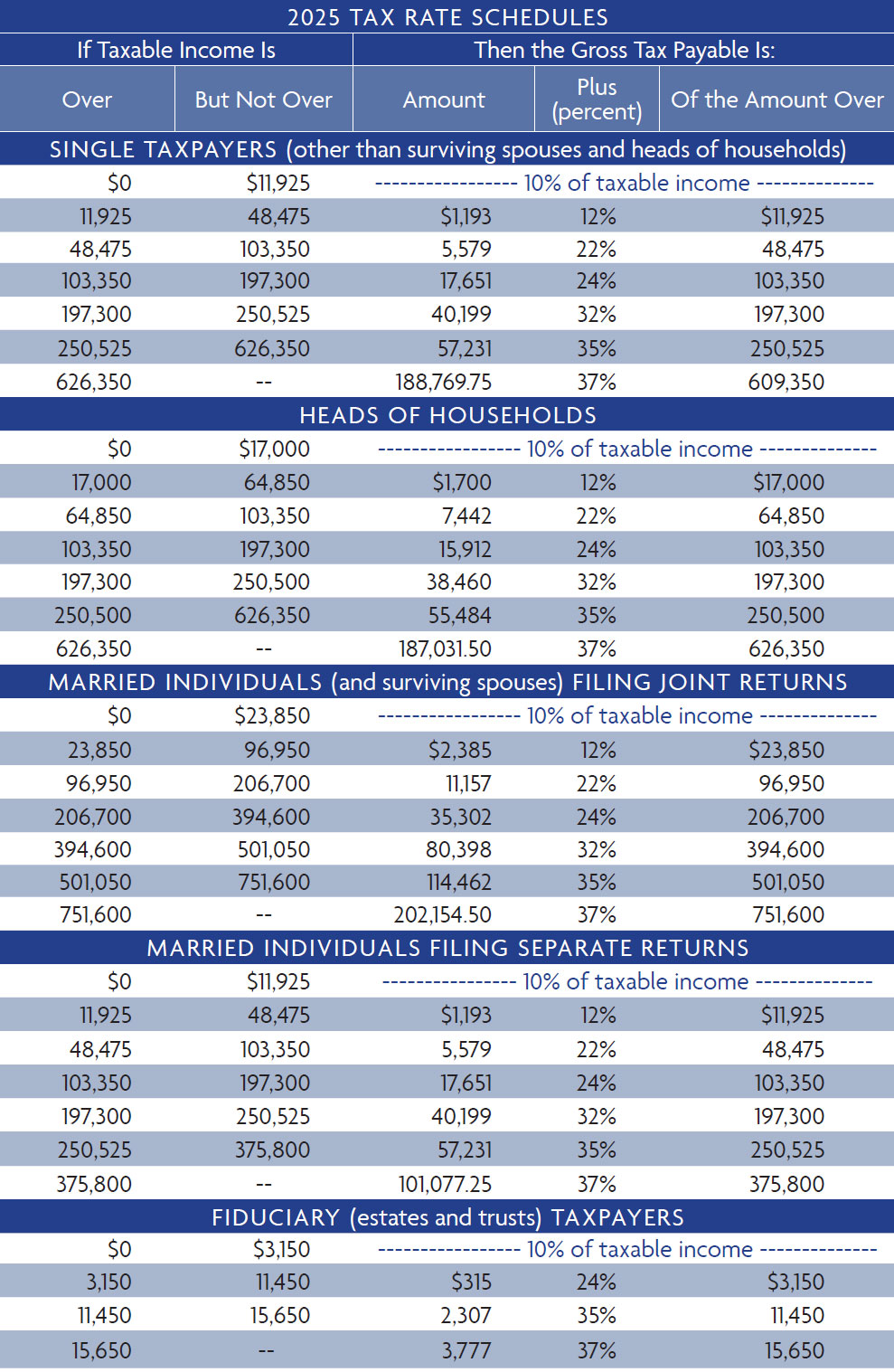

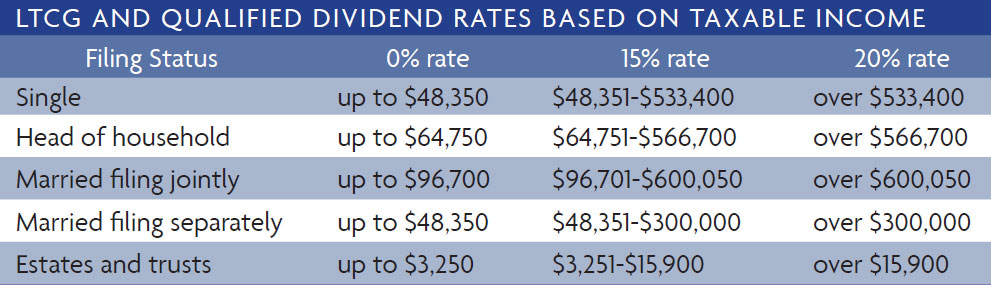

Income Taxes & Schedules

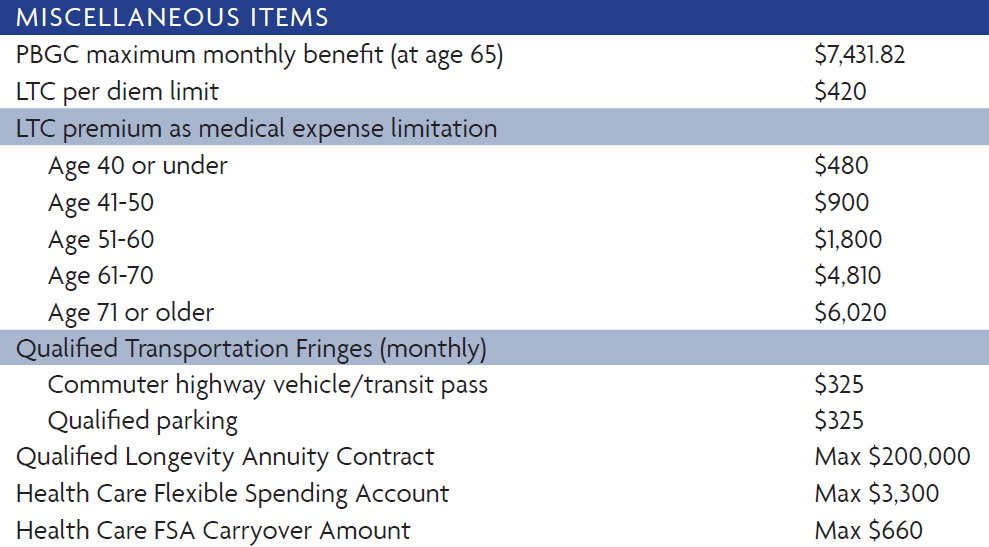

Other Items of Interest

This is intended to be informational in nature and should not be construed as an offer, solicitation, recommendation, endorsement of any security, or tax advice. As a division of Index Fund Advisors, Inc., IFA Taxes provides a wide array of tax planning, accounting and tax return preparation services for individuals and businesses across the United States. IFA Taxes does not provide auditing or attestation services and therefore is not a licensed CPA firm. IRS Circular 230 Disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any U.S. Federal tax advice contained in this communication is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction or matter herein.

For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.